Peace in Middle East but tensions Far East? - The markets next week (13.10.25 - 17.10.25)

Hello out there,

this is my first entry in the week ahead category. I want to give you a roadmap on hand, you can use when entering your positions. I will usually approach it in a top down fashion. Reviewing macro economic events and themes, coming down to potential set ups in NASDAQ, BTC and Gold (my preferred - but not only - assets I am trading).

So lets get into action: the tariff drumbeat just got louder—Team Trump floated 100% tariffs on China plus tighter export controls on “critical software,” but we’re still in threat territory, not rule-of-law in the Federal Register. Beijing’s answer was rhetorical pushback and tighter rare-earth export licensing—enough to inject daily headline risk, not yet a supply-chain choke.

Translation: every session from now on is a tape-bomb lottery, and if we get real time news or product lists, semiconductor stocks/EVs/networking are first in the splash zone.

Meanwhile, Japan’s 10-year near ~1.7%: Here the USD/JPY pair is my risk-o-meter: it’s simply how many yen you get for one US dollar. When it falls, the yen is getting stronger—and that often means global risk is tightening. Here’s the chain: Japan’s 10-year government bond yield (JGB) near ~1.7% makes it more attractive for Japanese pensions/insurers to keep money at home instead of buying U.S. Treasuries, which gently tugs demand away from the dollar and from risk. If the BOJ actually hikes the interest rate, that turbocharges the effect—holding yen pays more, the yen strengthens, and the famous carry trade (borrow cheap yen → buy higher-yield assets) gets unwound. Unwinds force selling in stocks and credit as traders repay yen, so high-beta tech tends to feel it first. In Japan, banks/insurers like higher rates; big exporters don’t love a stronger yen because overseas profits translate back into fewer yen.

Practical read: watch USD/JPY—a sharp drop says “risk-off is building.” In that case, avoid chasing rips in mega-cap tech, consider gold on dips as a policy-shock hedge, and run a Japan barbell (financials up, exporters selective) until the FX dust settles.

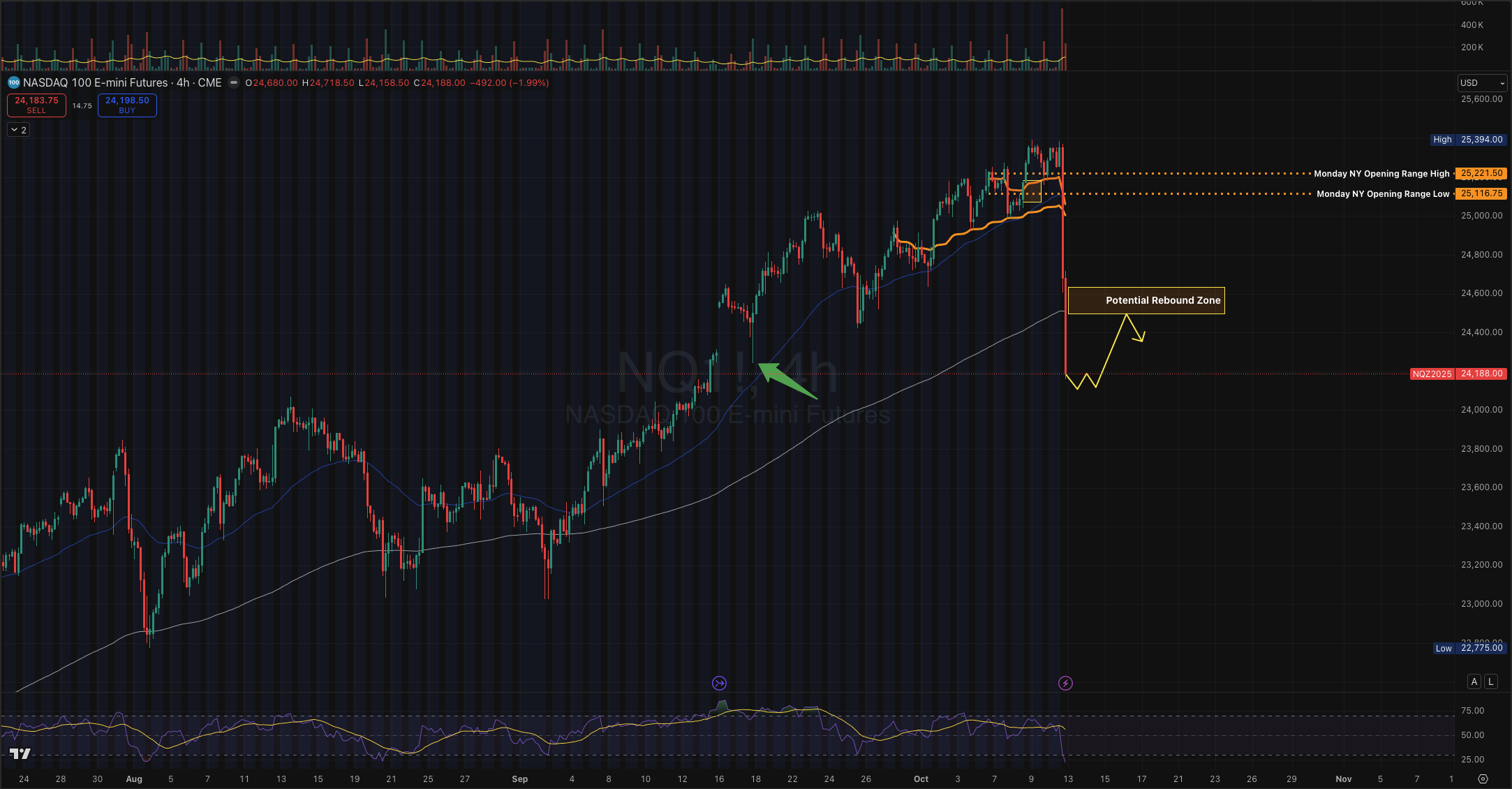

Lets go into the technical analysis of NASDAQ:

When the news broke that Trump wants to impose additional tariffs on China, the NQ future contract of NASDAQ (hereafter NQ) corrected sharply and recovered the stopping volume candle of September 17th. (green arrow). We need to see now how markets will react during Mondays asian session. I assume that there will be some rebound trading going on, however throughout the next days, focus on the news which come in:

- Mon 13 Oct: China Trade (Sep).

- Wed 15 Oct: US CPI (Sep); China CPI (Sep);

- Thu 16 Oct: US PPI (Sep), US Retail Sales (Sep), Initial Jobless Claims US

Depending on the sentiment of those news, we will see further upside (recover 25,300 zone) or more blood on the streets.

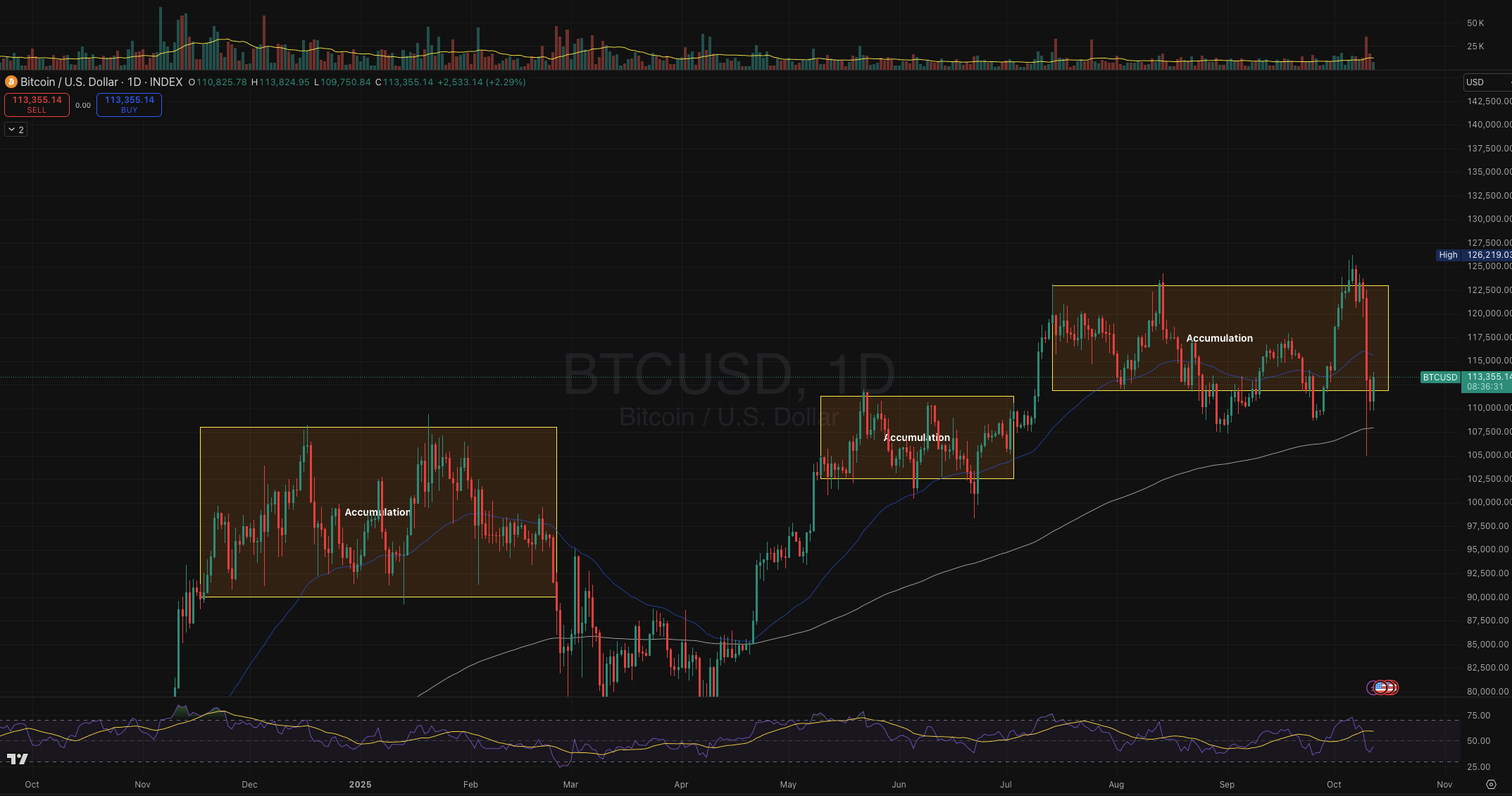

So how about BTC?

BTC took quite a hit as well on Friday, giving back all gains of this month. Will the "Uptober" loose its fame this year? We shall see. What BTC did not do was holding out at the levels despite the news. Hence we cannot assume that BTC has decoupled from the stock market. Since we have Wallstreet and the ETF now, this scenario will take a while to unfold. So what I expect for this week? As of this writing we see a rise above the yellow support box. Prices can go towards the 4h 200 EMA (white color) and hold there, waiting for the news mentioned above.

Looking on the daily time frame, we are back in the accumulation range between 113k to 123k. If we break beyond 125k, the next target shall be 150k, however I do not expect that this week. Uncertainties in the far east will create chopped price action.

Lastly Gold:

Gold confirmed its status as a safe heaven and closed positive on Friday. Looking at the big picture, I am expecting higher prices on gold given the volatile circumstances in the market. The additional volume going into gold (the pane above the price chart) shows traders strong commitment to push things higher. Furthermore the expectations for a further cut in interest rates by the FED will create a growing demand in gold.

Disclaimer: This post is for education and discussion only and does not constitute investment, legal, tax, or accounting advice. Markets are risky; you can lose more than you invest. Do your own research and consider your objectives, experience, and risk tolerance before acting. Past performance is not indicative of future results. We may reference third-party data we believe reliable but cannot guarantee accuracy or completeness. No fiduciary relationship is created by reading this content or interacting with us.